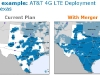

Well here’s some interesting Sunday news for you. This afternoon AT&T announced a definitive agreement with Deutsche Telekom (T-Mobile USA’s German-based parent company) under which AT&T will acquire T-Mobile USA from Deutsche Telekom in a cash-and-stock transaction valued at $39 billion. Should this deal go through, it will bring together T-Mobile’s current subscriber base of 33 million and AT&T’s 95 million customers thus making Ma Bell the largest wireless provider in the United States (for comparison’s sake, Verizon has 94 million customers). Furthermore, it will situate AT&T as the sole GSM provider to compete against CDMA rivals Verizon Wireless and Sprint. As far as 4G connectivity is concerned, AT&T plans to take advantage of T-Mobile’s installed infrastructure to significantly expand 4G LTE deployment to 95 percent of the U.S. population–reaching an additional 46.5 million Americans beyond current plans.

Says AT&T CEO Randall Stephenson: “This transaction represents a major commitment to strengthen and expand critical infrastructure for our nation’s future. It will improve network quality, and it will bring advanced LTE capabilities to more than 294 million people.”

Obviously the acquisition is subject to regulatory approvals, but if all goes smoothly the transaction will close in about 12 months, AT&T will have eaten up T-Mobile USA, and Deutsche Telekom will have an 8 percent stake in AT&T. Look after the break for the official PR statements from AT&T and Deutsche Telekom that cover the basics summarized here as well as additional notes about competition and financial information. Click through the gallery of images below to see how the merger will affect coverage in America.

Continue reading AT&T to acquire T-Mobile USA for $39 billion